options(repr.plot.width = 12, repr.plot.height = 6)EX 8.7 모의 실험 데이터

getwd()

'/home/coco/Dropbox/Scribbling/posts'

z <- scan("eg8_7.txt")

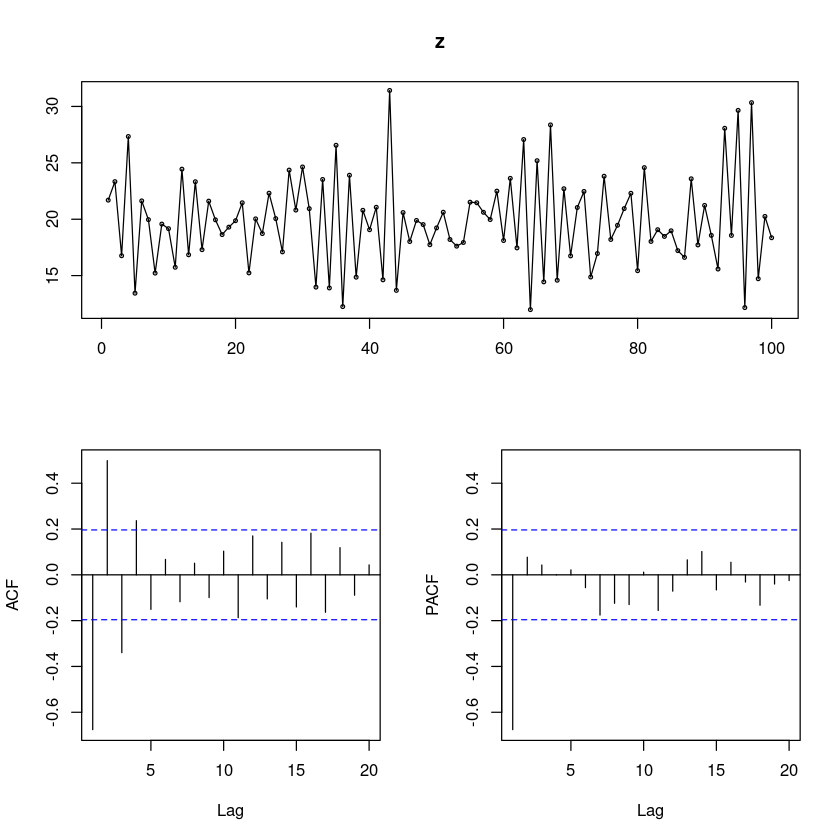

forecast::tsdisplay(z)Registered S3 method overwritten by 'quantmod':

method from

as.zoo.data.frame zoo

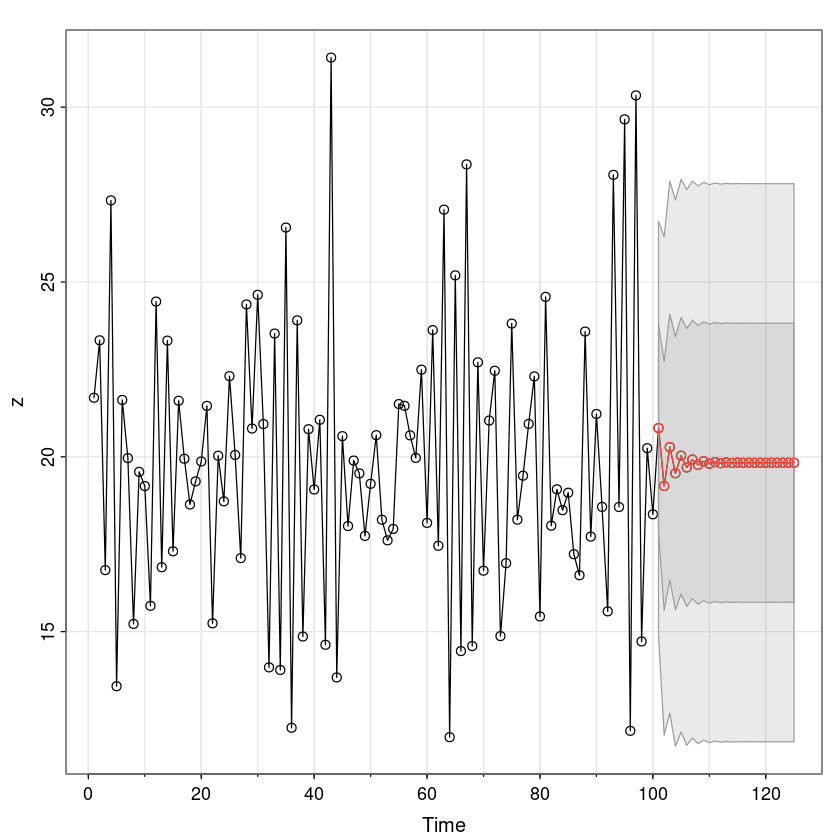

- 평균이 20정도로 움직이는 정상 시계열로 보인다. —> AR(1)모형

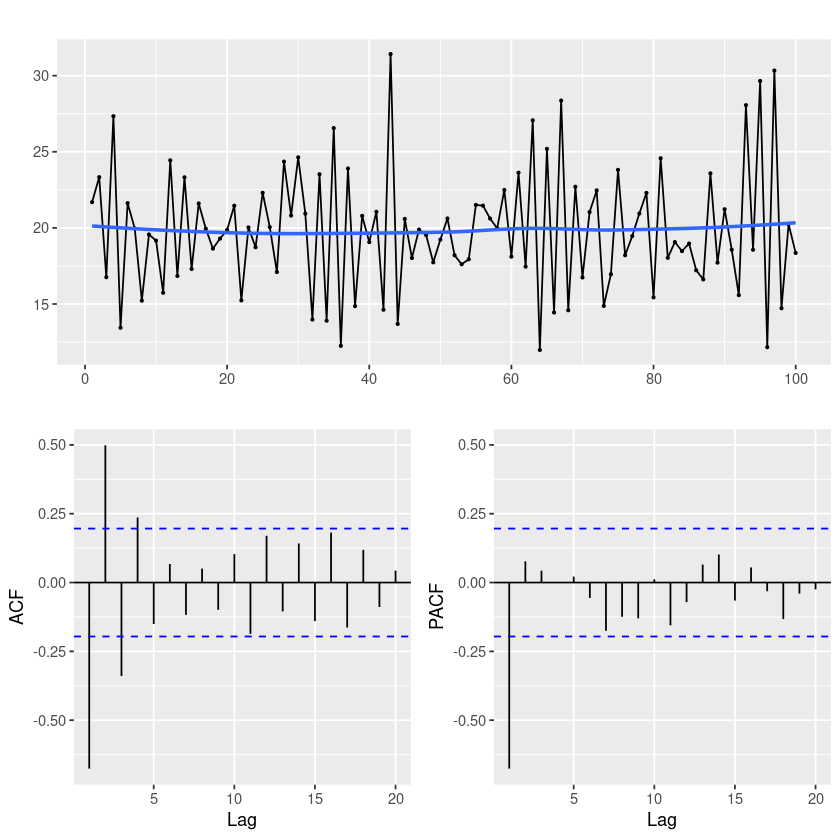

forecast::ggtsdisplay(z,

smooth=T)`geom_smooth()` using formula = 'y ~ x'

smooth=T를 쓰면 추세가 있는지 확인하는 파란 선이 생긴다.

fit <- arima(z, order=c(1,0,0), method='ML')

fit

Call:

arima(x = z, order = c(1, 0, 0), method = "ML")

Coefficients:

ar1 intercept

-0.6715 19.8312

s.e. 0.0728 0.1776

sigma^2 estimated as 8.744: log likelihood = -250.61, aic = 507.22mean(z)

19.832691

intercept는 delta가 아니라 mu이다.

\(\hat Z_n(l) = \hat μ + \hat ϕ^l(Z_n − \hat μ)\)

length(z)

100

- 예측하는 함수

- 모형을 기준으로 25개를 예측할거야!

forecast_fit <- forecast::forecast(fit, 25) #MMSE : zn(l) = mu + phi^l*(zn-mu), l=1,...,25

forecast_fit Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

101 20.82225 17.03269 24.61181 15.02662 26.61788

102 19.16558 14.60082 23.73034 12.18439 26.14678

103 20.27811 15.40393 25.15229 12.82369 27.73253

104 19.53100 14.52353 24.53847 11.87273 27.18926

105 20.03272 14.96628 25.09915 12.28427 27.78116

106 19.69579 14.60299 24.78859 11.90702 27.48456

107 19.92205 14.81740 25.02670 12.11517 27.72893

108 19.77011 14.66013 24.88009 11.95507 27.58515

109 19.87214 14.75976 24.98453 12.05343 27.69086

110 19.80362 14.69015 24.91709 11.98325 27.62399

111 19.84964 14.73568 24.96359 12.02852 27.67076

112 19.81874 14.70456 24.93291 11.99728 27.64019

113 19.83949 14.72521 24.95376 12.01788 27.66110

114 19.82555 14.71123 24.93987 12.00387 27.64723

115 19.83491 14.72057 24.94925 12.01320 27.65662

116 19.82863 14.71428 24.94297 12.00690 27.65035

117 19.83285 14.71849 24.94720 12.01112 27.65457

118 19.83001 14.71566 24.94437 12.00828 27.65174

119 19.83191 14.71756 24.94627 12.01018 27.65365

120 19.83064 14.71628 24.94499 12.00890 27.65237

121 19.83150 14.71714 24.94585 12.00976 27.65323

122 19.83092 14.71656 24.94527 12.00919 27.65265

123 19.83131 14.71695 24.94566 12.00957 27.65304

124 19.83105 14.71669 24.94540 12.00931 27.65278

125 19.83122 14.71686 24.94558 12.00949 27.65295- 직접 계산

coef(fit)- ar1

- -0.671544059932036

- intercept

- 19.8311503070686

hat_phi <- coef(fit)[1]

hat_mu <- coef(fit)[2]hat_mu + hat_phi * (z[100] - hat_mu) # l= 1 z_100_(1)

hat_mu + hat_phi^2 * (z[100] - hat_mu) # l= 2 z_100_(2)

intercept: 20.8222488141294

intercept: 19.1655839918444

- 100번째를 기준으로 그 다음값을 구하고 싶어.

l <- 1:10

sapply(l, function(x) hat_mu + hat_phi^x * (z[100] - hat_mu))- intercept

- 20.8222488141294

- intercept

- 19.1655839918444

- intercept

- 20.2781074125482

- intercept

- 19.5309989178393

- intercept

- 20.0327151895859

- intercept

- 19.6957906075232

- intercept

- 19.9220503092525

- intercept

- 19.7701069505542

- intercept

- 19.8721436105341

- intercept

- 19.8036214976293

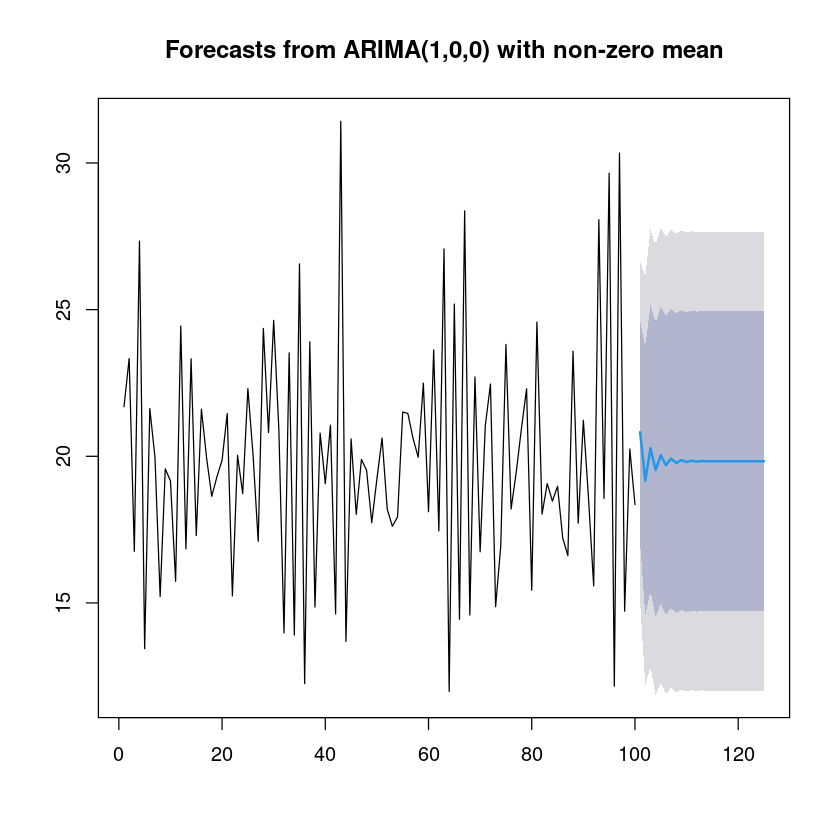

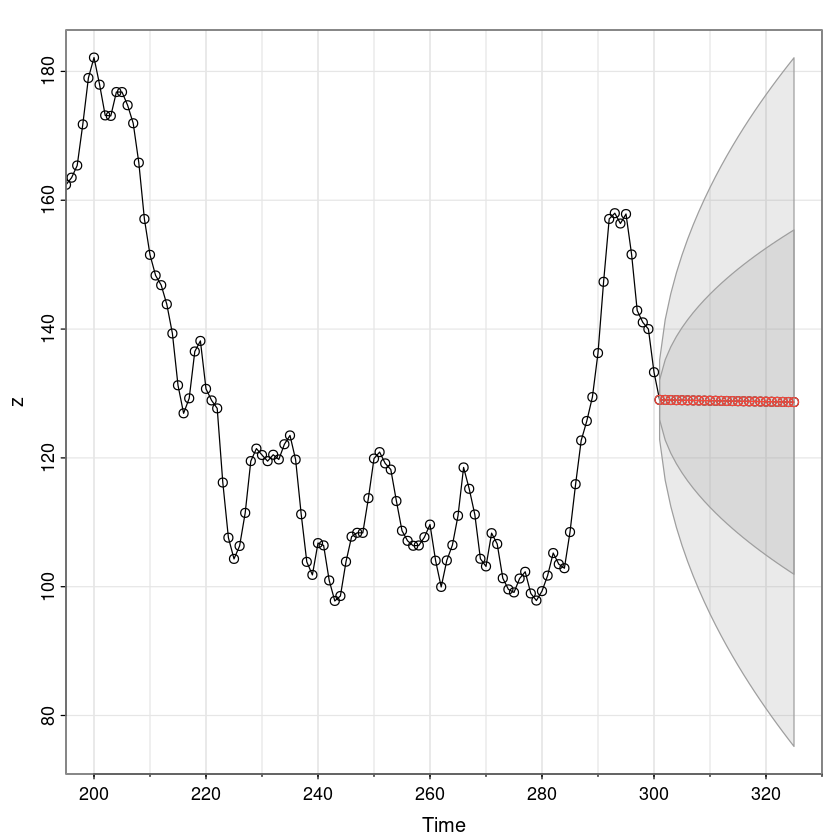

plot(forecast_fit)

점점 평균값으로 수렴한다.

AR process의 정보가 점점 사라지는 것..

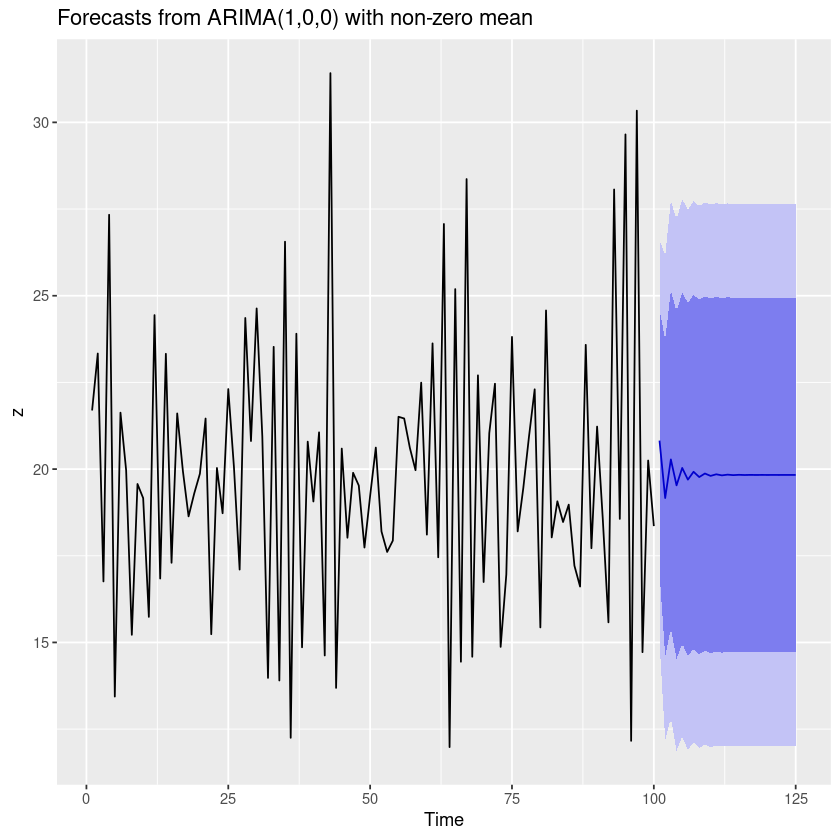

ggplot2::autoplot(forecast_fit)

sarima_fit <- astsa::sarima.for(z,25,1,0,0) # z함수, 25개 볼거야, p, d, q

sarima_fit$pred

sarima_fit$se

A Time Series:

- 20.8222483489762

- 19.1655839559512

- 20.2781070098918

- 19.5309988141942

- 20.032714849742

- 19.6957904500696

- 19.9220500133516

- 19.7701067583474

- 19.8721433414928

- 19.8036212850204

- 19.849636861772

- 19.8187353767205

- 19.8394870839858

- 19.8255513992216

- 19.8349098248857

- 19.8286252301641

- 19.8328456121207

- 19.830011439887

- 19.8319147112811

- 19.8306365807722

- 19.8314949016627

- 19.8309185014078

- 19.8313055795478

- 19.8310456395405

- 19.831220200696

A Time Series:

- 2.95700711959937

- 3.5619005566917

- 3.80334404182832

- 3.90734998536685

- 3.95335857242263

- 3.97393285636323

- 3.98317649989949

- 3.98733810739122

- 3.98921345277822

- 3.99005889146209

- 3.99044010149264

- 3.9906120043846

- 3.99068952524303

- 3.99072448443737

- 3.99074024993262

- 3.99074735969909

- 3.990750565996

- 3.99075201194324

- 3.99075266402387

- 3.99075295809352

- 3.9907530907105

- 3.99075315051696

- 3.99075317748796

- 3.99075318965111

- 3.99075319513634

head(sarima_fit$pred + qnorm(0.975)*sarima_fit$se) ##95% 신뢰구간 상한

head(sarima_fit$pred - qnorm(0.975)*sarima_fit$se) ##95% 신뢰구간 하한

A Time Series:

- 26.6178758054195

- 26.1467807635801

- 27.7325243526903

- 27.1892640605063

- 27.781155269663

- 27.4845557255219

A Time Series:

- 15.0266208925329

- 12.1843871483223

- 12.8236896670933

- 11.8727335678821

- 12.2842744298209

- 11.9070251746172

EX 9.5 IMA(1,1) = ARIMA(0,1,1)

- 차분을 했더니 MA(1)모형

z <- scan("eg9_5.txt")

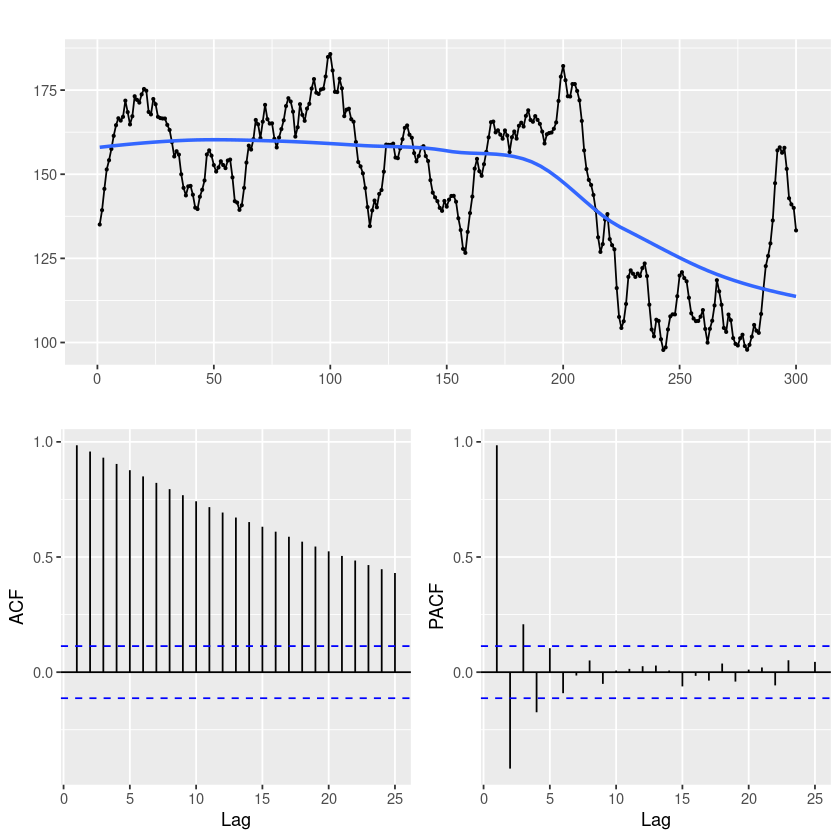

forecast::ggtsdisplay(z, smooth=T)`geom_smooth()` using formula = 'y ~ x'

- ACF가 천천히 감소한다. (확률적 추세가 있어보임)

##단위근 검정 : H0 : 단위근이 있다.

fUnitRoots::adfTest(z, lags = 0, type = "c")

fUnitRoots::adfTest(z, lags = 1, type = "c")

fUnitRoots::adfTest(z, lags = 2, type = "c")

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 0

STATISTIC:

Dickey-Fuller: -1.43

P VALUE:

0.5246

Description:

Tue Dec 5 20:19:59 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 1

STATISTIC:

Dickey-Fuller: -2.3543

P VALUE:

0.1803

Description:

Tue Dec 5 20:19:59 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 2

STATISTIC:

Dickey-Fuller: -1.7307

P VALUE:

0.4126

Description:

Tue Dec 5 20:19:59 2023 by user: 평균이 있으니 ‘C’ 옵션을 사용하자.

모든 차수에 대해서 p-value < 0.05이므로 차분이 필요하다.

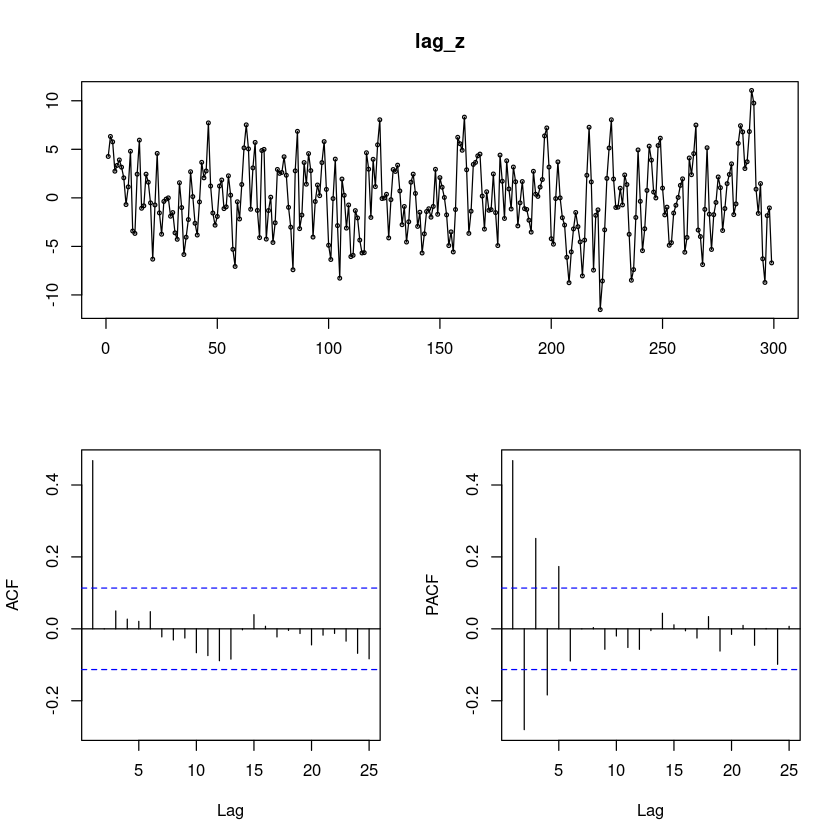

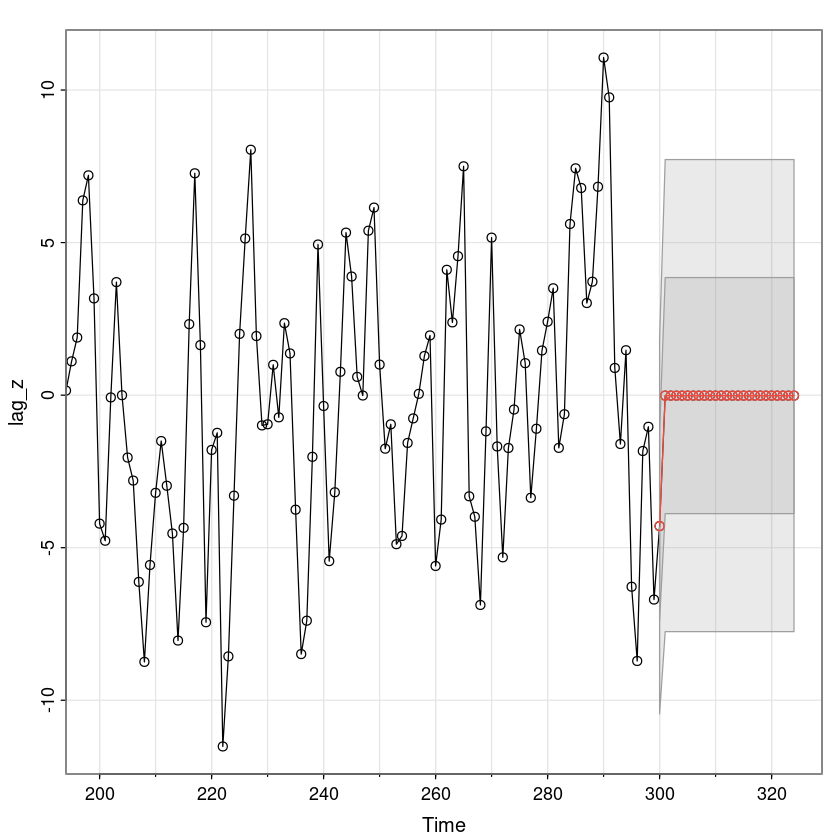

lag_z <- diff(z)

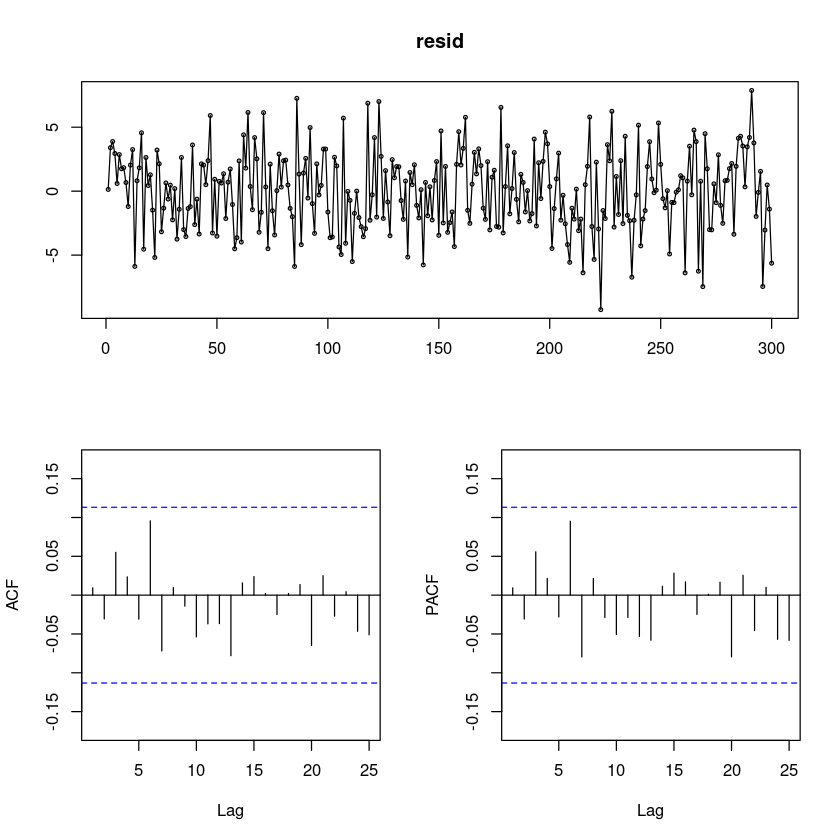

forecast::tsdisplay(lag_z)

0을 중심으로 움직인다.

PACF가 SIN함수를 그리며 지수적으로 감소함

ACF가 1차에만 유효하고 나머지는 유효하지 않음 -> MA(1)모형

## mean : H0 : mu = 0

t.test(lag_z)

One Sample t-test

data: lag_z

t = -0.02617, df = 298, p-value = 0.9791

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-0.4480209 0.4362617

sample estimates:

mean of x

-0.005879599 - 유의확률이 크게 나와서 평균이 0이 맞아!

- 차분한 모형(평균 F)

fit1 <- arima(lag_z, order=c(0,0,1), include.mean = F)

fit1

Call:

arima(x = lag_z, order = c(0, 0, 1), include.mean = F)

Coefficients:

ma1

0.7605

s.e. 0.0342

sigma^2 estimated as 9.479: log likelihood = -760.93, aic = 1525.86- 원래 모형(평균 있음)

fit <- arima(z, order=c(0,1,1))

fit

Call:

arima(x = z, order = c(0, 1, 1))

Coefficients:

ma1

0.7605

s.e. 0.0342

sigma^2 estimated as 9.479: log likelihood = -760.93, aic = 1525.86- 두 가지 방법이 모두 동일하게 나온다.

\(Z_t = ε_t + 0.7605ε_t, \hat θ = −0.7605\)

부호가 반대!!!

MA모형 평균이 없당

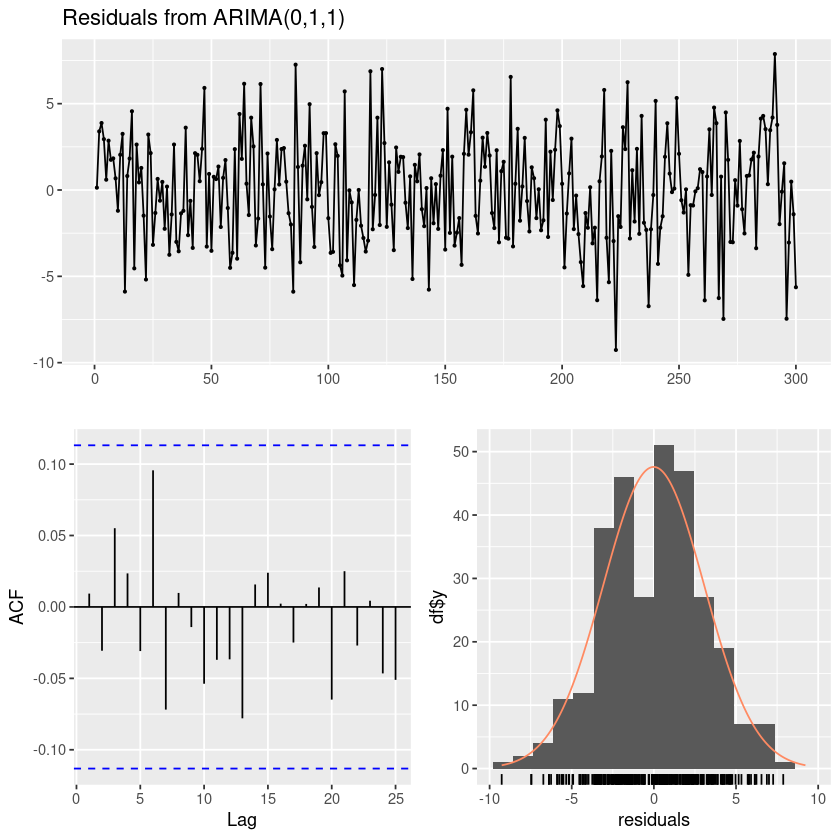

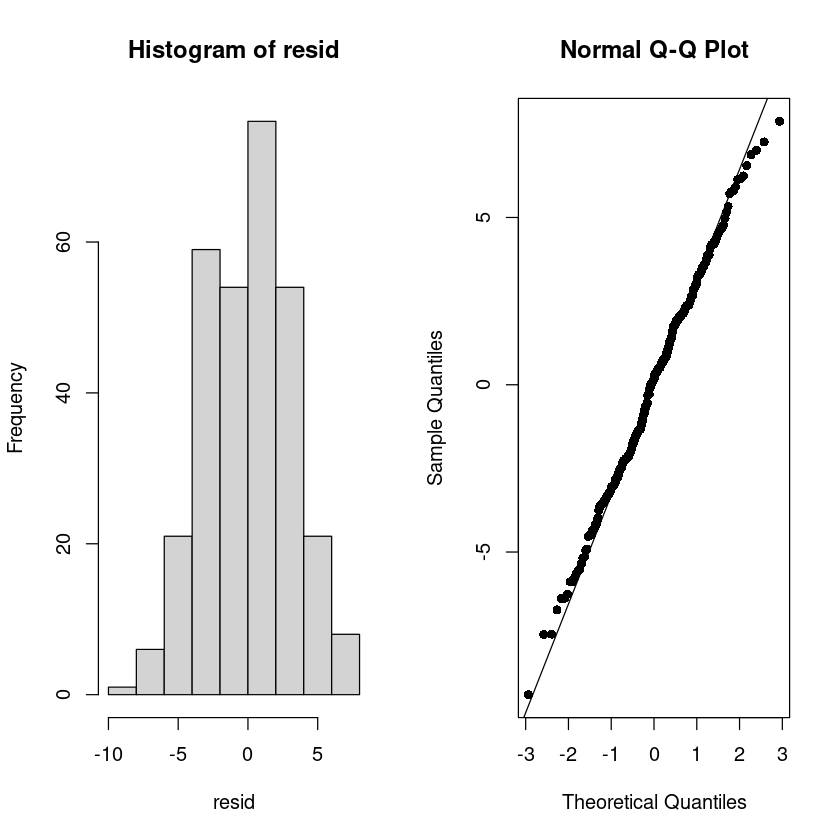

- 잔차분석

forecast::checkresiduals(fit)

Ljung-Box test

data: Residuals from ARIMA(0,1,1)

Q* = 7.1117, df = 9, p-value = 0.6255

Model df: 1. Total lags used: 10

정규분포

10개시차까지 모든 cov가 0

WN이다

resid = resid(fit)

forecast::tsdisplay(resid)

# 잔차의 포트맨토 검정 ## H0 : rho1=...=rho_k=0

portes::LjungBox(fit, lags=c(6,12,18,24))| lags | statistic | df | p-value | |

|---|---|---|---|---|

| 6 | 4.520231 | 5 | 0.4771812 | |

| 12 | 7.964175 | 11 | 0.7165093 | |

| 18 | 10.346863 | 17 | 0.8884381 | |

| 24 | 12.926680 | 23 | 0.9535620 |

## 정규성검정

tseries::jarque.bera.test(resid) ##JB test H0: normal

Jarque Bera Test

data: resid

X-squared = 1.1606, df = 2, p-value = 0.5597par(mfrow=c(1,2))

hist(resid)

qqnorm(resid, pch=16)

qqline(resid)

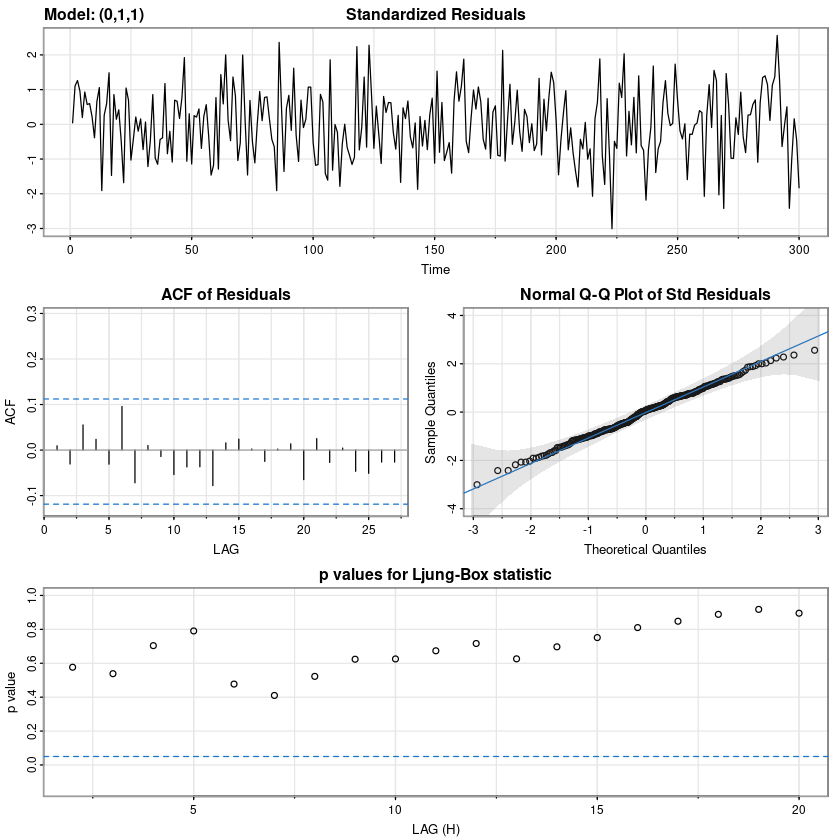

## 잔차 검정

astsa::sarima(z, p=0, d=1, q=1)initial value 1.355425

iter 2 value 1.182804

iter 3 value 1.144176

iter 4 value 1.129179

iter 5 value 1.127095

iter 6 value 1.125914

iter 7 value 1.125753

iter 8 value 1.125727

iter 9 value 1.125726

iter 10 value 1.125726

iter 11 value 1.125726

iter 11 value 1.125726

final value 1.125726

converged

initial value 1.125981

iter 2 value 1.125979

iter 3 value 1.125977

iter 4 value 1.125975

iter 5 value 1.125974

iter 6 value 1.125974

iter 6 value 1.125974

final value 1.125974

converged$fit

Call:

arima(x = xdata, order = c(p, d, q), seasonal = list(order = c(P, D, Q), period = S),

xreg = constant, transform.pars = trans, fixed = fixed, optim.control = list(trace = trc,

REPORT = 1, reltol = tol))

Coefficients:

ma1 constant

0.7605 -0.0146

s.e. 0.0342 0.3130

sigma^2 estimated as 9.479: log likelihood = -760.93, aic = 1527.86

$degrees_of_freedom

[1] 297

$ttable

Estimate SE t.value p.value

ma1 0.7605 0.0342 22.2124 0.0000

constant -0.0146 0.3130 -0.0468 0.9627

$AIC

[1] 5.109891

$AICc

[1] 5.110027

$BIC

[1] 5.14702

\((1-B)\hat Z_n (l) = \hat \mu - \hat \theta \hat \epsilon_n: l=1\)

\(\hat \mu: l \geq 2\)

- 원데이터를예측하는 거니까 원데이터 넣어주기(차분데이터X)

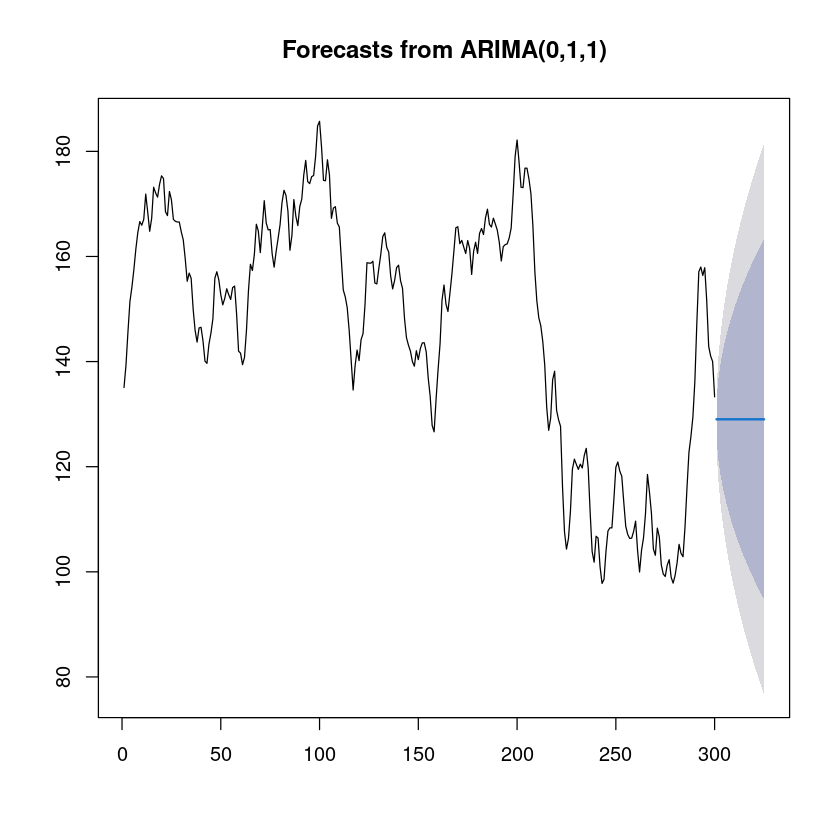

fore_fit <- forecast::forecast(fit, 25)

fore_fit Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

301 129.0191 125.07348 132.9647 122.98480 135.0534

302 129.0191 121.03051 137.0077 116.80160 141.2366

303 129.0191 118.43291 139.6053 112.82893 145.2093

304 129.0191 116.35746 141.6807 109.65480 148.3834

305 129.0191 114.57726 143.4609 106.93221 151.1060

306 129.0191 112.99361 145.0446 104.51022 153.5280

307 129.0191 111.55296 146.4852 102.30694 155.7313

308 129.0191 110.22240 147.8158 100.27203 157.7662

309 129.0191 108.98000 149.0582 98.37194 159.6663

310 129.0191 107.81025 150.2279 96.58297 161.4552

311 129.0191 106.70173 151.3365 94.88763 163.1506

312 129.0191 105.64572 152.3925 93.27261 164.7656

313 129.0191 104.63541 153.4028 91.72746 166.3107

314 129.0191 103.66532 154.3729 90.24384 167.7944

315 129.0191 102.73101 155.3072 88.81493 169.2233

316 129.0191 101.82878 156.2094 87.43509 170.6031

317 129.0191 100.95554 157.0827 86.09959 171.9386

318 129.0191 100.10867 157.9295 84.80441 173.2338

319 129.0191 99.28591 158.7523 83.54611 174.4921

320 129.0191 98.48531 159.5529 82.32170 175.7165

321 129.0191 97.70517 160.3330 81.12858 176.9096

322 129.0191 96.94400 161.0942 79.96448 178.0737

323 129.0191 96.20049 161.8377 78.82736 179.2108

324 129.0191 95.47344 162.5648 77.71544 180.3228

325 129.0191 94.76183 163.2764 76.62712 181.4111plot(fore_fit)

- 평균으로 거의 예측이 됨.

astsa::sarima.for(z, 25, 0,1,1)- $pred

- A Time Series:

- 129.010634626429

- 128.995997383896

- 128.981360141362

- 128.966722898829

- 128.952085656296

- 128.937448413762

- 128.922811171229

- 128.908173928696

- 128.893536686162

- 128.878899443629

- 128.864262201096

- 128.849624958562

- 128.834987716029

- 128.820350473496

- 128.805713230962

- 128.791075988429

- 128.776438745896

- 128.761801503362

- 128.747164260829

- 128.732527018296

- 128.717889775762

- 128.703252533229

- 128.688615290696

- 128.673978048162

- 128.659340805629

- $se

- A Time Series:

- 3.07876798320946

- 6.23357705966339

- 8.26051775756748

- 9.88002147201177

- 11.2691390510429

- 12.5048856698518

- 13.6290438505565

- 14.6672937839507

- 15.6367572600282

- 16.5495271314128

- 17.4145203476207

- 18.2385358404128

- 19.0268983354184

- 19.7838704739663

- 20.5129276700085

- 21.2169477602064

- 21.898345666366

- 22.5591713852255

- 23.2011828201129

- 23.8259009256026

- 24.434652147738

- 25.0286015639165

- 25.6087790983797

- 26.1761005035879

- 26.7313843307499

astsa::sarima.for(lag_z, 25, 0,0,1)- $pred

- A Time Series:

- -4.29136464101854

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- $se

- A Time Series:

- 3.07876823197791

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

- 3.86796612789283

fore_diff_z <- astsa::sarima.for(lag_z, 25, 0,0,1, plot=F)$pred

fore_diff_z

A Time Series:

- -4.29136464101854

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

- -0.014636625581003

fore_diff_z_ <- forecast::forecast(fit1, 25)

fore_diff_z_$mean # 차분한 값에 대한 예측

A Time Series:

- -4.28290139590614

- 0

- 0

- 0

- 0

- 0

- 0

- 0

- 0

- 0

- 0

- 0

- 0

- 0

- 0

- 0

- 0

- 0

- 0

- 0

- 0

- 0

- 0

- 0

- 0

fore_z <- astsa::sarima.for(z, 25, 0,1,1, plot=F)$pred

fore_z

A Time Series:

- 129.010634626429

- 128.995997383896

- 128.981360141362

- 128.966722898829

- 128.952085656296

- 128.937448413762

- 128.922811171229

- 128.908173928696

- 128.893536686162

- 128.878899443629

- 128.864262201096

- 128.849624958562

- 128.834987716029

- 128.820350473496

- 128.805713230962

- 128.791075988429

- 128.776438745896

- 128.761801503362

- 128.747164260829

- 128.732527018296

- 128.717889775762

- 128.703252533229

- 128.688615290696

- 128.673978048162

- 128.659340805629

fore_z_ <- forecast::forecast(fit,25)

fore_z_$mean

A Time Series:

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 129.01909823039

- 차분한 값에.. 원래데이터의 예측값을 알고 싶다면?

\(\widehat{▽Z_t} = \hat Z_t − \hat Z_{t−1}\)

\(\hat Z_t = \widehat{▽Z_t} + \hat Z_{t−1}\)

\(\hat Z_{300}(1) = \widehat{▽Z_{300}(1)} + Z_{300}\)

z_300_1 <- as.numeric(fore_diff_z[1]) + z[300]

z_300_1

129.010635358981

\(\hat Z_{300}(2) = \widehat{▽Z_{300}(2)} + \hat Z_{300}(1)\)

z_300_2 <- fore_diff_z[2] + z_300_1

z_300_2

128.9959987334